NEWSLETTER

Disclaimer: The information in these graphs/stats is derived from observed data and may not be entirely accurate. Please consider it as a general reference.

www.lethagencies.com

YOUR PREFERRED AGENT IN MARITIME HOTSPOTS

November 2024Issue 001

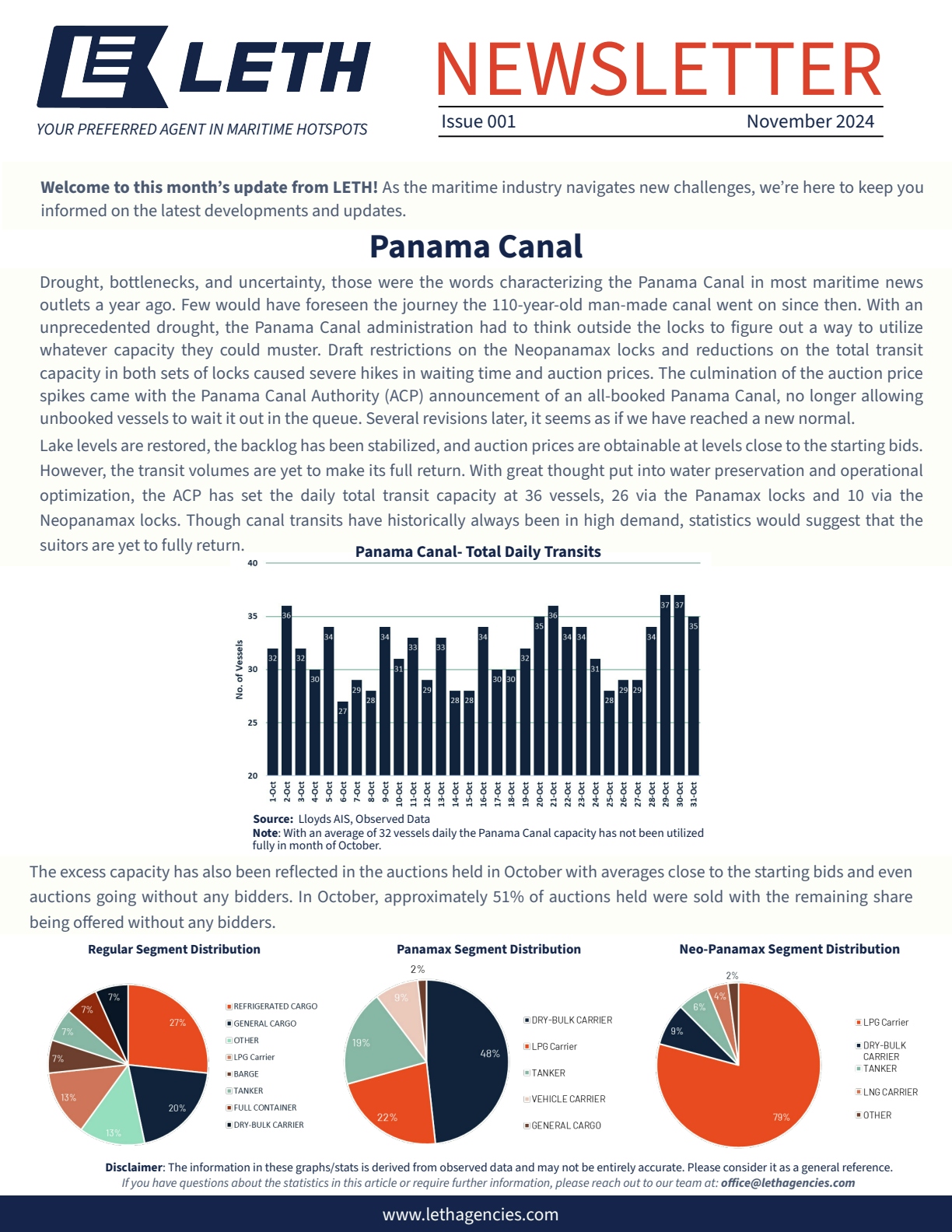

Lake levels are restored, the backlog has been stabilized, and auction prices are obtainable at levels close to the starting bids.

However, the transit volumes are yet to make its full return. With great thought put into water preservation and operational

optimization, the ACP has set the daily total transit capacity at 36 vessels, 26 via the Panamax locks and 10 via the

Neopanamax locks. Though canal transits have historically always been in high demand, statistics would suggest that the

suitors are yet to fully return.

The excess capacity has also been reflected in the auctions held in October with averages close to the starting bids and even

auctions going without any bidders. In October, approximately 51% of auctions held were sold with the remaining share

being offered without any bidders.

If you have questions about the statistics in this article or require further information, please reach out to our team at:

[email protected]

Drought, bottlenecks, and uncertainty, those were the words characterizing the Panama Canal in most maritime news

outlets a year ago. Few would have foreseen the journey the 110-year-old man-made canal went on since then. With an

unprecedented drought, the Panama Canal administration had to think outside the locks to figure out a way to utilize

whatever capacity they could muster. Draft restrictions on the Neopanamax locks and reductions on the total transit

capacity in both sets of locks caused severe hikes in waiting time and auction prices. The culmination of the auction price

spikes came with the Panama Canal Authority (ACP) announcement of an all-booked Panama Canal, no longer allowing

unbooked vessels to wait it out in the queue. Several revisions later, it seems as if we have reached a new normal.

Welcome to this month’s update from LETH! As the maritime industry navigates new challenges, we’re here to keep you

informed on the latest developments and updates.

Panama Canal

Note: With an average of 32 vessels daily the Panama Canal capacity has not been utilized

fully in month of October.

Source: Lloyds AIS, Observed Data

Panama Canal- Total Daily Transits

Panamax Segment Distribution Neo-Panamax Segment DistributionRegular Segment Distribution YOUR PREFERRED AGENT IN MARITIME HOTSPOTS

MaltaPanama Spain GibraltarDenmarkEgypt Singapore Turkey

Suez Canal Insights

“While areas around Egypt are challenged by unrest, the Suez Canal remains safe. As agents, we are seeing a

rather high activity with crew changes, deliveries, coordination of vessel related services, to those vessels either

transiting the canal or calling Egyptian ports in the Mediterranean or Red Sea. With owned cars, minibuses and

launch boats, our Egyptian staff is kept busy to a very large extend. Despite of the rather dark skies, we can

conclude that our services are still being requested, which obviously is a great honour for us”

Update from our analyst at Guardian

In Guardian, our Risk Advisory team closely monitors the Middle East developments to aid our clients with insights and

operational recommendations. In the Red Sea, Yemen-based Houthi rebels are still disrupting commercial shipping,

compromising the essential supply chains for international trade. Attacks dropped in September and October to about

three per month, likely due to fewer targets as vessels avoid the region and deterrence from UK, US, and Israeli airstrikes.

The Houthis target any ship linked to Israel or its allies, and further attacks are likely through November. These attacks,

involving drones, missiles, and sea mines, are driving up shipping costs and global inflationary pressures. The Red Sea

conflict remains a significant geopolitical flashpoint with far-reaching consequences for global trade and stability. Making

route adjustments, enhancing onboard security protocols, staying informed, and having operational flexibility are advisable

for vessels in the area.

The Turkish Straits which cover the straits of Dardanelles

and Bosporus are a fundamental part in the worldwide

trade, as it connects the Aegean Sea to the Black Sea. We

have been an important player in the region since 2001,

using the customer oriented and pro-active approach we

have gained in the Suez Canal to create a product that both

our customers and their vessels can confidently rely on. To

reach our goal to become the leading transit agent we have

partnered with Inchcape shipping services in 2024, allowing

us to combine our excellent customer service and business

models with the extensive infrastructure and local presence

that Inchcape provides. The result is a product offering

unparalleled levels of customer service across the full

spectre of agency services.

-Jacob Guldager

Branch Manager & Business Development Director

Middle East Update

Our new strategic partnership in the Turkish Straits

LETH NEWSLETTER NOVEMBER 2024

If you have questions about the statistics in this article or require further information, please reach out to our team at: off

[email protected]

NEWSLETTER

Disclaimer: The information in these graphs/stats is derived from observed data and may not be entirely accurate. Please consider it as a general reference.

www.lethagencies.com

YOUR PREFERRED AGENT IN MARITIME HOTSPOTS

November 2024Issue 001

Lake levels are restored, the backlog has been stabilized, and auction prices are obtainable at levels close to the starting bids.

However, the transit volumes are yet to make its full return. With great thought put into water preservation and operational

optimization, the ACP has set the daily total transit capacity at 36 vessels, 26 via the Panamax locks and 10 via the

Neopanamax locks. Though canal transits have historically always been in high demand, statistics would suggest that the

suitors are yet to fully return.

The excess capacity has also been reflected in the auctions held in October with averages close to the starting bids and even

auctions going without any bidders. In October, approximately 51% of auctions held were sold with the remaining share

being offered without any bidders.

If you have questions about the statistics in this article or require further information, please reach out to our team at:

[email protected]

Drought, bottlenecks, and uncertainty, those were the words characterizing the Panama Canal in most maritime news

outlets a year ago. Few would have foreseen the journey the 110-year-old man-made canal went on since then. With an

unprecedented drought, the Panama Canal administration had to think outside the locks to figure out a way to utilize

whatever capacity they could muster. Draft restrictions on the Neopanamax locks and reductions on the total transit

capacity in both sets of locks caused severe hikes in waiting time and auction prices. The culmination of the auction price

spikes came with the Panama Canal Authority (ACP) announcement of an all-booked Panama Canal, no longer allowing

unbooked vessels to wait it out in the queue. Several revisions later, it seems as if we have reached a new normal.

Welcome to this month’s update from LETH! As the maritime industry navigates new challenges, we’re here to keep you

informed on the latest developments and updates.

Panama Canal

Note: With an average of 32 vessels daily the Panama Canal capacity has not been utilized

fully in month of October.

Source: Lloyds AIS, Observed Data

Panama Canal- Total Daily Transits

Panamax Segment Distribution Neo-Panamax Segment DistributionRegular Segment Distribution YOUR PREFERRED AGENT IN MARITIME HOTSPOTS

MaltaPanama Spain GibraltarDenmarkEgypt Singapore Turkey

Suez Canal Insights

“While areas around Egypt are challenged by unrest, the Suez Canal remains safe. As agents, we are seeing a

rather high activity with crew changes, deliveries, coordination of vessel related services, to those vessels either

transiting the canal or calling Egyptian ports in the Mediterranean or Red Sea. With owned cars, minibuses and

launch boats, our Egyptian staff is kept busy to a very large extend. Despite of the rather dark skies, we can

conclude that our services are still being requested, which obviously is a great honour for us”

Update from our analyst at Guardian

In Guardian, our Risk Advisory team closely monitors the Middle East developments to aid our clients with insights and

operational recommendations. In the Red Sea, Yemen-based Houthi rebels are still disrupting commercial shipping,

compromising the essential supply chains for international trade. Attacks dropped in September and October to about

three per month, likely due to fewer targets as vessels avoid the region and deterrence from UK, US, and Israeli airstrikes.

The Houthis target any ship linked to Israel or its allies, and further attacks are likely through November. These attacks,

involving drones, missiles, and sea mines, are driving up shipping costs and global inflationary pressures. The Red Sea

conflict remains a significant geopolitical flashpoint with far-reaching consequences for global trade and stability. Making

route adjustments, enhancing onboard security protocols, staying informed, and having operational flexibility are advisable

for vessels in the area.

The Turkish Straits which cover the straits of Dardanelles

and Bosporus are a fundamental part in the worldwide

trade, as it connects the Aegean Sea to the Black Sea. We

have been an important player in the region since 2001,

using the customer oriented and pro-active approach we

have gained in the Suez Canal to create a product that both

our customers and their vessels can confidently rely on. To

reach our goal to become the leading transit agent we have

partnered with Inchcape shipping services in 2024, allowing

us to combine our excellent customer service and business

models with the extensive infrastructure and local presence

that Inchcape provides. The result is a product offering

unparalleled levels of customer service across the full

spectre of agency services.

-Jacob Guldager

Branch Manager & Business Development Director

Middle East Update

Our new strategic partnership in the Turkish Straits

LETH NEWSLETTER NOVEMBER 2024

If you have questions about the statistics in this article or require further information, please reach out to our team at: off

[email protected]

NEWSLETTER

Disclaimer: The information in these graphs/stats is derived from observed data and may not be entirely accurate. Please consider it as a general reference.

www.lethagencies.com

YOUR PREFERRED AGENT IN MARITIME HOTSPOTS

November 2024Issue 001

Lake levels are restored, the backlog has been stabilized, and auction prices are obtainable at levels close to the starting bids.

However, the transit volumes are yet to make its full return. With great thought put into water preservation and operational

optimization, the ACP has set the daily total transit capacity at 36 vessels, 26 via the Panamax locks and 10 via the

Neopanamax locks. Though canal transits have historically always been in high demand, statistics would suggest that the

suitors are yet to fully return.

The excess capacity has also been reflected in the auctions held in October with averages close to the starting bids and even

auctions going without any bidders. In October, approximately 51% of auctions held were sold with the remaining share

being offered without any bidders.

If you have questions about the statistics in this article or require further information, please reach out to our team at:

[email protected]

Drought, bottlenecks, and uncertainty, those were the words characterizing the Panama Canal in most maritime news

outlets a year ago. Few would have foreseen the journey the 110-year-old man-made canal went on since then. With an

unprecedented drought, the Panama Canal administration had to think outside the locks to figure out a way to utilize

whatever capacity they could muster. Draft restrictions on the Neopanamax locks and reductions on the total transit

capacity in both sets of locks caused severe hikes in waiting time and auction prices. The culmination of the auction price

spikes came with the Panama Canal Authority (ACP) announcement of an all-booked Panama Canal, no longer allowing

unbooked vessels to wait it out in the queue. Several revisions later, it seems as if we have reached a new normal.

Welcome to this month’s update from LETH! As the maritime industry navigates new challenges, we’re here to keep you

informed on the latest developments and updates.

Panama Canal

Note: With an average of 32 vessels daily the Panama Canal capacity has not been utilized

fully in month of October.

Source: Lloyds AIS, Observed Data

Panama Canal- Total Daily Transits

Panamax Segment Distribution Neo-Panamax Segment DistributionRegular Segment Distribution YOUR PREFERRED AGENT IN MARITIME HOTSPOTS

MaltaPanama Spain GibraltarDenmarkEgypt Singapore Turkey

Suez Canal Insights

“While areas around Egypt are challenged by unrest, the Suez Canal remains safe. As agents, we are seeing a

rather high activity with crew changes, deliveries, coordination of vessel related services, to those vessels either

transiting the canal or calling Egyptian ports in the Mediterranean or Red Sea. With owned cars, minibuses and

launch boats, our Egyptian staff is kept busy to a very large extend. Despite of the rather dark skies, we can

conclude that our services are still being requested, which obviously is a great honour for us”

Update from our analyst at Guardian

In Guardian, our Risk Advisory team closely monitors the Middle East developments to aid our clients with insights and

operational recommendations. In the Red Sea, Yemen-based Houthi rebels are still disrupting commercial shipping,

compromising the essential supply chains for international trade. Attacks dropped in September and October to about

three per month, likely due to fewer targets as vessels avoid the region and deterrence from UK, US, and Israeli airstrikes.

The Houthis target any ship linked to Israel or its allies, and further attacks are likely through November. These attacks,

involving drones, missiles, and sea mines, are driving up shipping costs and global inflationary pressures. The Red Sea

conflict remains a significant geopolitical flashpoint with far-reaching consequences for global trade and stability. Making

route adjustments, enhancing onboard security protocols, staying informed, and having operational flexibility are advisable

for vessels in the area.

The Turkish Straits which cover the straits of Dardanelles

and Bosporus are a fundamental part in the worldwide

trade, as it connects the Aegean Sea to the Black Sea. We

have been an important player in the region since 2001,

using the customer oriented and pro-active approach we

have gained in the Suez Canal to create a product that both

our customers and their vessels can confidently rely on. To

reach our goal to become the leading transit agent we have

partnered with Inchcape shipping services in 2024, allowing

us to combine our excellent customer service and business

models with the extensive infrastructure and local presence

that Inchcape provides. The result is a product offering

unparalleled levels of customer service across the full

spectre of agency services.

-Jacob Guldager

Branch Manager & Business Development Director

Middle East Update

Our new strategic partnership in the Turkish Straits

LETH NEWSLETTER NOVEMBER 2024

If you have questions about the statistics in this article or require further information, please reach out to our team at: off

[email protected]